AREAS OF PRACTICE

Ms. Sampson holds a Real Estate Broker license, is an active member of many county Realty Boards, and is a licensed attorney in New York and New Jersey. This combination allows her to provide the expert, holistic legal services you need when handling issues related to guardianship, special needs, and elder law, to property tax appeals, living wills, real estate financing, and more.

Ms. Sampson is able to assist her clients in a wide variety of ways. For example, by decreasing their assessments through tax certiorari processes, Ms. Sampson helps both commercial and residential clients reduce their property tax burden. She draws on her extensive real estate experience in doing so. Her knowledge of property tax assessment is also useful for estate and tax planning, as it may enable her to make early saving decisions that end up saving her clients thousands of dollars.

Keep reading to find out a little more about the ways that Ms. Sampson can help you, as well.

Asset Protection

Asset protection is more crucial than ever due to the increasing likelihood of litigation and the growing number of liability concerns. We live in a victim-oriented claim society in the United States. Threats to your finances could come from anyone. At Sampson Law Group, we have strong asset protection solutions that can offer the ideal layer of asset protection and assist secure your privacy, whether you're trying to fend off identity theft or head off a potential future issue.

To meet the needs of a wide spectrum of clients, we provide several asset protection planning strategies. Gifting, charity trusts, irrevocable spendthrift trusts, and marriage trusts are all ways that estate planning can protect assets. Here are a few more:

- Insurance

- Marital Property

- Business Entity – The Selection

- Real Estate

- Limited Liability Corporations (LLC’s)

- Family Limited Partnerships (FLP’s)

- Charging Orders

- Domestic Asset Protection Trusts (DAPT’s)

- Spendthrift Clauses

- Foreign Asset Protection Trusts (FAPT’s)

Business Law

Business law deals with business transactions, client rights, interpersonal interactions, and the behavior of those engaged in trade, commerce, and sales. Advertising and marketing, e-commerce, intellectual property rights, labor and employment law, privacy, the environment, contracts, and workplace safety are all governed by the laws of business. Your choice of entity, tax choices, business succession planning, and the jurisdictions your business serves all have an impact on your bottom line, regardless of whether you run a small or large business. The Sampson Law Group can assist you in sorting through these concerns and advising you on the best course of action.

Elder Law & Special Needs

Elder Law

The term "elder law" is used to refer to a broad range of legal practice areas with a focus on problems involving the elderly and disabled segments of our population. Estate planning, Medicaid & Medicare planning, Medicaid coverage, long-term disability planning, Special Needs planning, real estate transactions, tax planning, guardianship, asset preservation, retirement planning, Social Security, wills, trusts, protection from elder abuse and neglect, end-of-life planning, disability and medical care planning, medical directives, powers of attorney, mortgages, contracts, client advocacy, and Veteran’s planning.

Special Needs

The Sampson Law Group is here to help people and their loved ones through the enormous and perplexing challenges of special needs trusts and planning. Even if you are unable to be there to care for your loved ones, you can still safeguard them via careful planning.

Sampson Law Group helps those who are disabled and those who care about them develop a "life care plan" that strikes a balance between their needs and the law as it stands, ensuring that the disabled person retains any entitlement to government benefits and is able to live a more fulfilling life that complements but does not replace those benefits.

Sampson Law Group offers a full complement of Supplemental needs Planning including:

- Special Needs Trusts

- Supplemental Needs Trusts

- Letters of Guidance

- Recommendations for Pool Trusts

- Advice on Joinder Agreements and Remainder Planning

- Guardianships under 17A and Article 81

- Self-Settled Special Needs Trusts Third Party Supplemental Needs Trusts

- Testamentary Supplemental Needs Trusts

- Support Trusts

- Answers to Questions about Advanced Directives

- Medicaid Planning

- Medicare

- Social Security Disability Issues

- Supplemental Social Security Income Issues

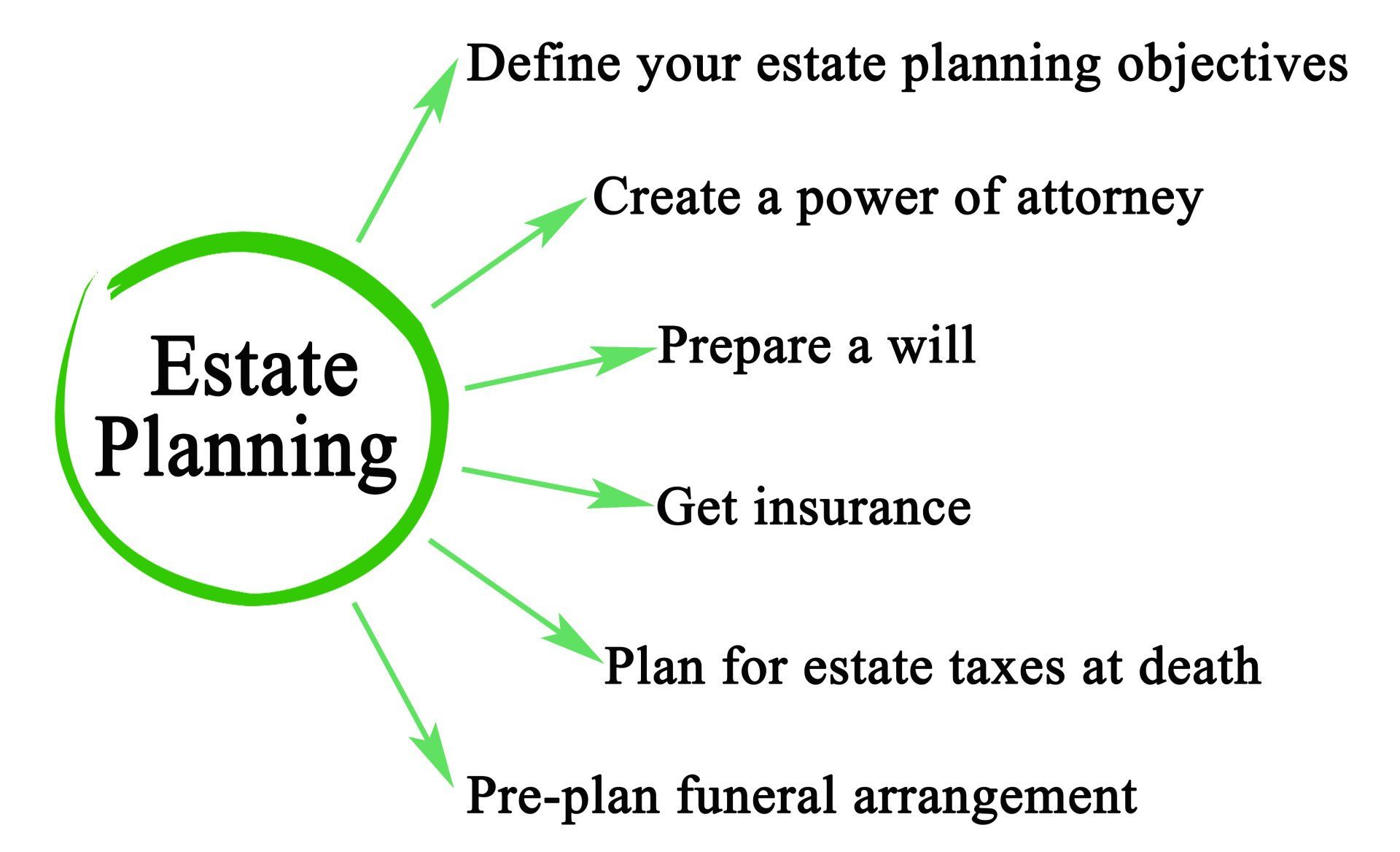

Estate Planning

The continual process of anticipating and setting up for asset transfers during a person's lifetime and the equitable distribution of assets to the person's legitimate heirs after death is known as estate planning.

Regardless of your wealth, estate planning aims to remove some ambiguities that surround the distribution of assets. Estate planning aims to achieve specific planning objectives such probate avoidance, trust creation, guardianship, and incapacity planning in addition to reducing income and estate tax liabilities whenever possible. Planning for elder law, asset protection, and estates intersect to some extent.

Prudence and ongoing planning that considers life changes, such as the loss of a loved one, divorce, new or blended family relationships, new business partnerships, significant changes in your net worth for any reason, retirement planning, and moves from one state to another, are the cornerstones of any successful estate plan.

The Sampson Law Group is here for you, no matter what your needs are, to provide you with the advice you need to make the best decisions for your situation.

Personal Injury

A personal injury occurs whenever you sustain an injury to your body, mind, or emotions. In contrast to property damage, personal injury refers to harm to the person.

You may be entitled to compensation if someone else's improper or negligent actions resulted in a serious injury to you. You might need to make a legal claim in order to be granted damages. Some of your damages may be covered by insurance claims, but you will probably need to make a claim against the person who hurt you. Depending on the state you live in, there is a statute of limitations that applies.

Even though you are the victim, you still need to prove some aspects of your claim. You must establish separate factors concerning causation and harm when your injury is the result of carelessness, intentional tort, or strict responsibility. Preponderance of the evidence is what constitutes the burden of proof. This implies that you must demonstrate that the defendant is more likely than not to be at fault for your injuries.

Your losses go beyond only your medical expenses. Depending on your facts and circumstances, lost pay, pain and suffering, losses of personal property, and past and future medical expenses are all considered.

Real Estate

The Sampson Law Group actively handles situations involving the following (and more):

- Advising builders and developers of real estate about the laws and regulations surrounding land use

- Creating or representing clients on residential or commercial leases

- Handling of joint ownership arrangements

- Like kind exchanges, also known as 1031 exchanges

- Purchase and sales of residential and commercial properties

- Representing clients involved in Estate valuations of real property & closings

- Succession planning for Business owners involving real property

- Work outs of distressed properties

Real Estate Law also entails applying legal knowledge from other fields, such as estate planning, estate and gift tax, income tax, zoning laws, landlord-tenant law, real property law, commercial law, lien law, mortgages, and business law.

A deed that accurately describes the land must be executed, delivered, and legally registered in order to transfer title. At the closing, adjustments must be made for pre-paid or upcoming property taxes and municipal fees. Mortgages are frequently either established or removed from title and declared "settled." The property must be "clear" in order to be a marketable title. Performing and certifying a title search is necessary to find out whether the title is clear or marketable.

Serving the following New York Counties:

Bronx, Dutchess, Kings, Nassau, Orange, Putnam, Queens, Rockland, Suffolk, & Westchester.

Including the following cities and towns:

Bedford, Cortlandt, Eastchester, Greenburgh, Harrison, Lewisboro, Mamaroneck, Mount Kisco, Mount Pleasant, Mount Vernon, New Castle, New Rochelle, North Castle, North Salem, Ossining, Peekskill, Pelham, Pound Ridge, Port Chester, Rye, Rye Brook, Scarsdale, White Plains, Yonkers & Yorktown.

BROWSE OUR WEBSITE

HOURS OF OPERATION

- Mon - Fri

- -

- Sat - Sun

- Closed