WHEN TIMES ARE DIFFICULT, WE CAN HELP YOU GET THROUGH THEM.

WELCOME TO THE SAMPSON LAW GROUP

There are many detours, turns and unexpected twists in life. It may be impossible to foresee exactly how problems and events will develop in our lives, but there are resources available for seeking expert legal help. At the Sampson Law Group, we help clients of all ages who are planning with matters such as asset protection, estate planning, elder law planning, tax planning, guardianships, wills, and trusts, as well as business and real estate planning and transactions, personal injury, and special needs planning solutions.

Let Sampson Law Group help you navigate life's journey and guide you through difficult financial and socioeconomic times.

Life is a journey that takes many twists and turns. It is impossible to predict exactly how to handle issues and events that arise during our lives, however there are places to turn for professional advice. At the Sampson Law Group we assist people of all ages who are preparing for the future with: asset protection, estate planning, elder law planning, tax planning, guardianships, wills, trusts, business planning and business transactions, real estate transactions, personal injury, special needs planning, Solo 401K Pension solutions, and more. We have resources available for those who need assistance with caring for a loved one. Whether it is clients who are facing long-term care issues or the parents and grandparents of special needs children, we are here to help. We understand wealth management. We know how difficult it can be when life's plans and dreams go off course, however, we have the skills, knowledge and resources to help you sort it all out and get back on track.

ASSET PROTECTION, ELDER LAW, PROBATE & MORE

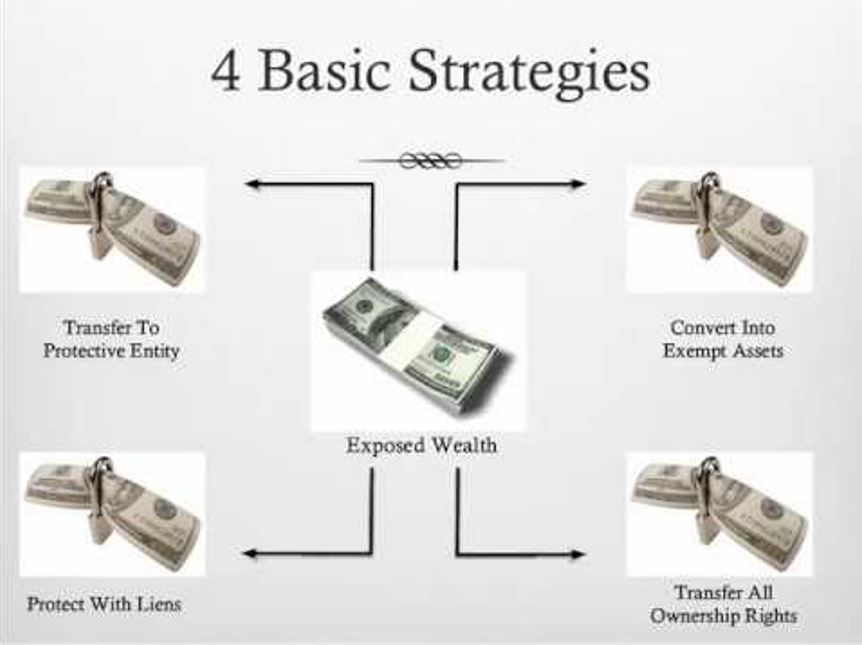

Asset Protection

Wealth management is something we know. Although it can be challenging when life's plans and dreams are derailed, we have the expertise, know-how, and resources to assist you in getting everything back on track.

Business Law

Business law deals with business transactions, client rights, interpersonal interactions, and the behavior of those engaged in trade, commerce, and sales. Advertising and marketing, e-commerce, intellectual property rights, labor and employment law, privacy, the environment, contracts, and workplace safety are all governed by the laws of business.

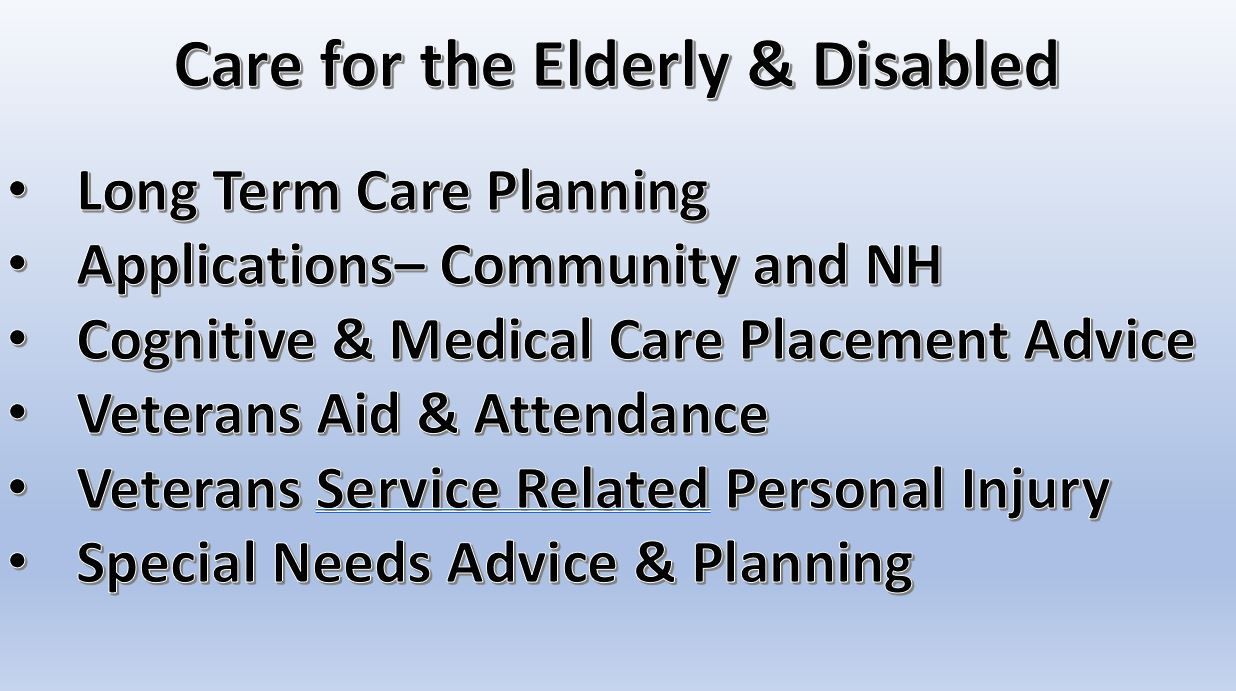

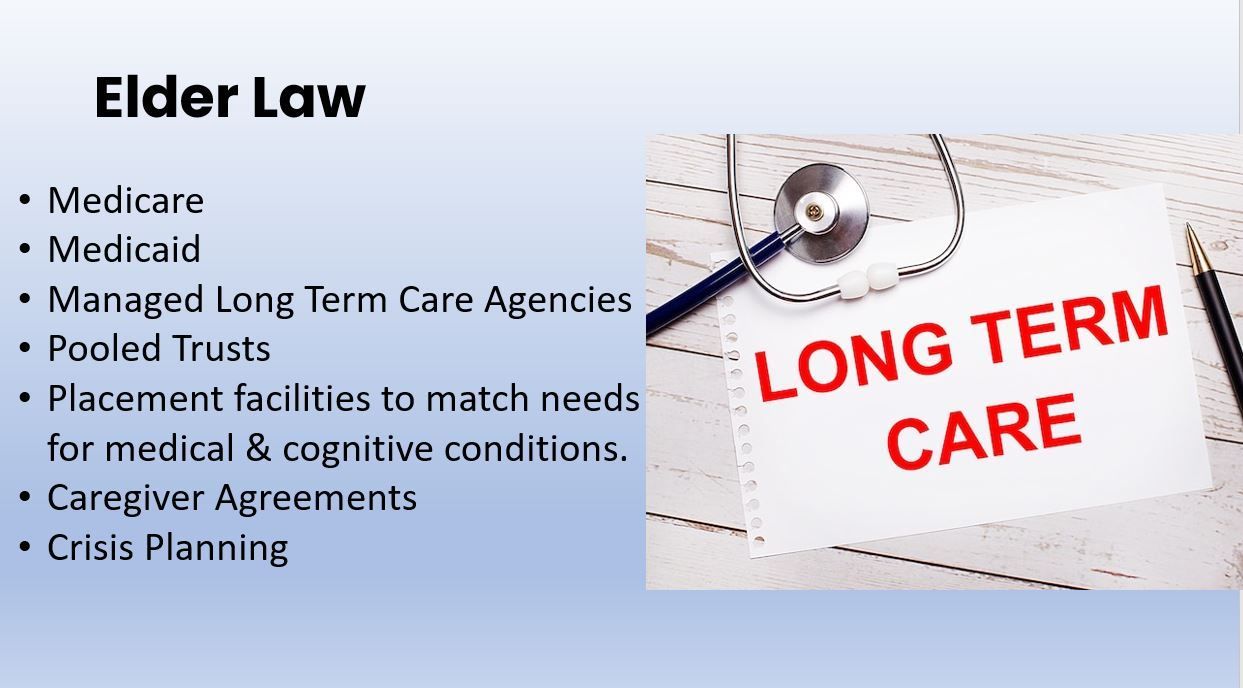

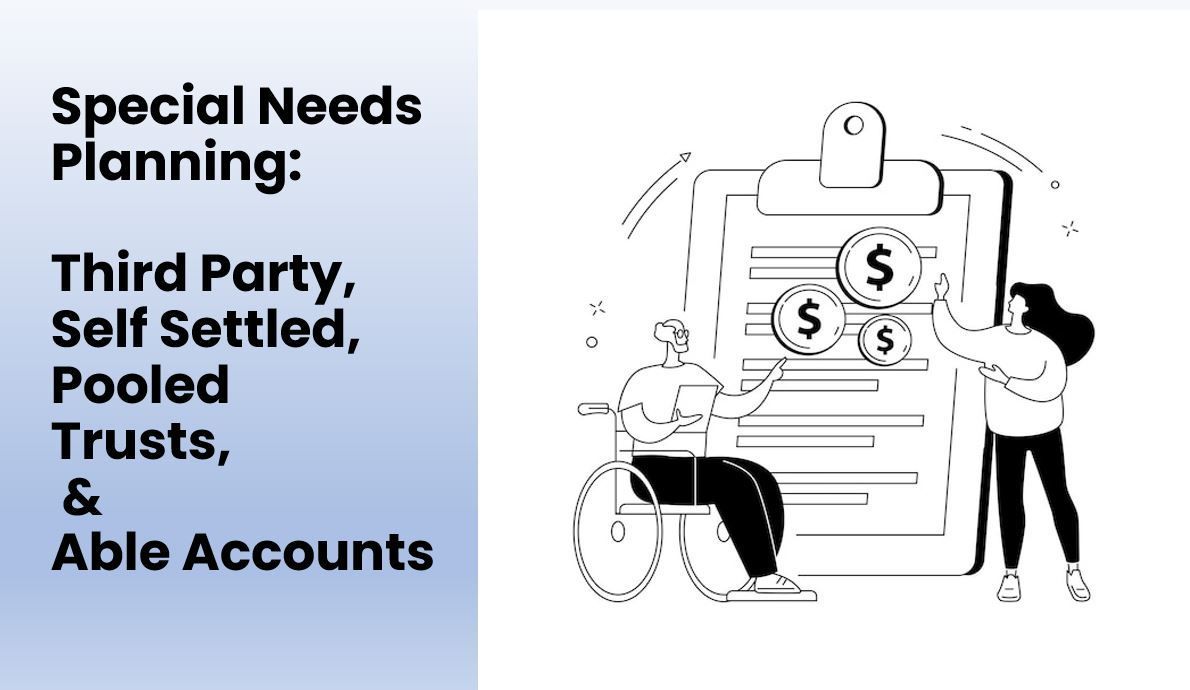

Elder Law & Special Needs

- Community and Nursing Home Medicaid Applications

For individuals who require assistance with

caring for a loved one, we have services accessible. We are here to support everyone, whether they are clients dealing with long-term care difficulties or the parents and grandparents of special needs kids.

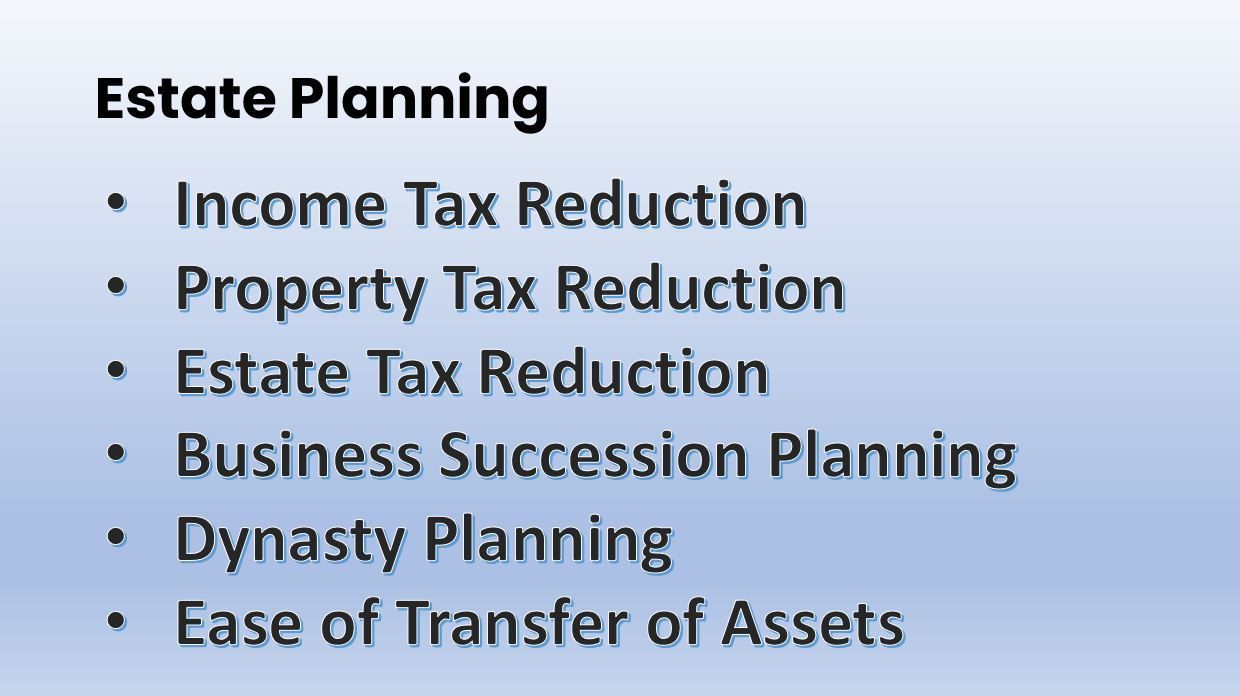

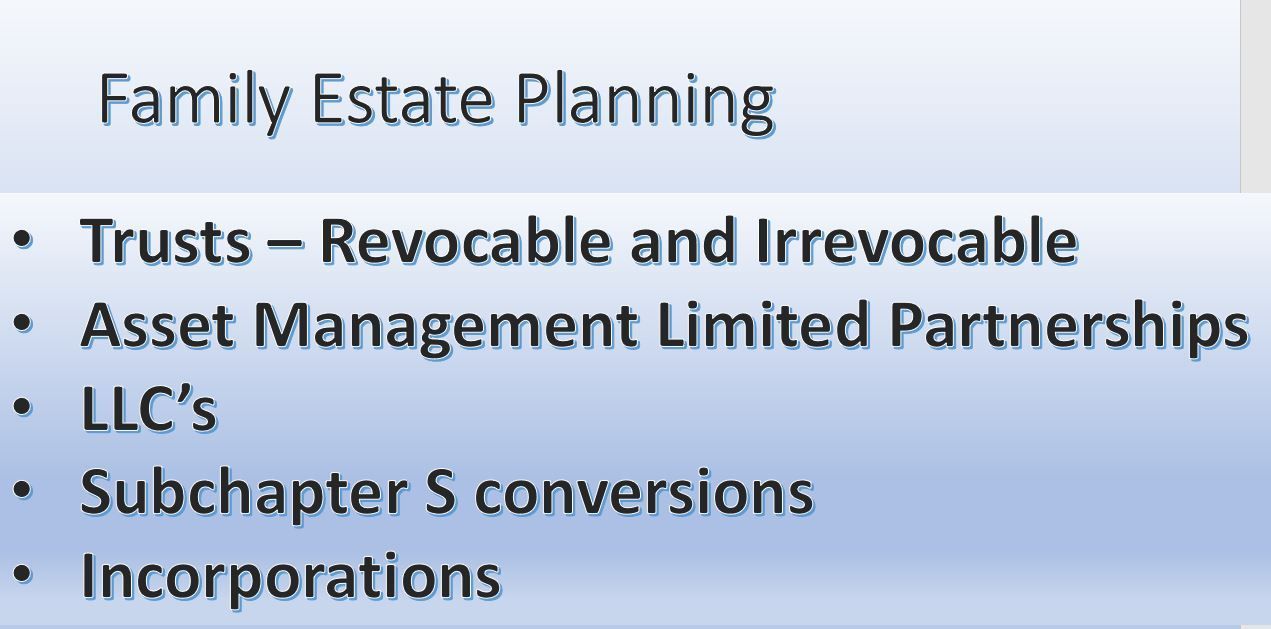

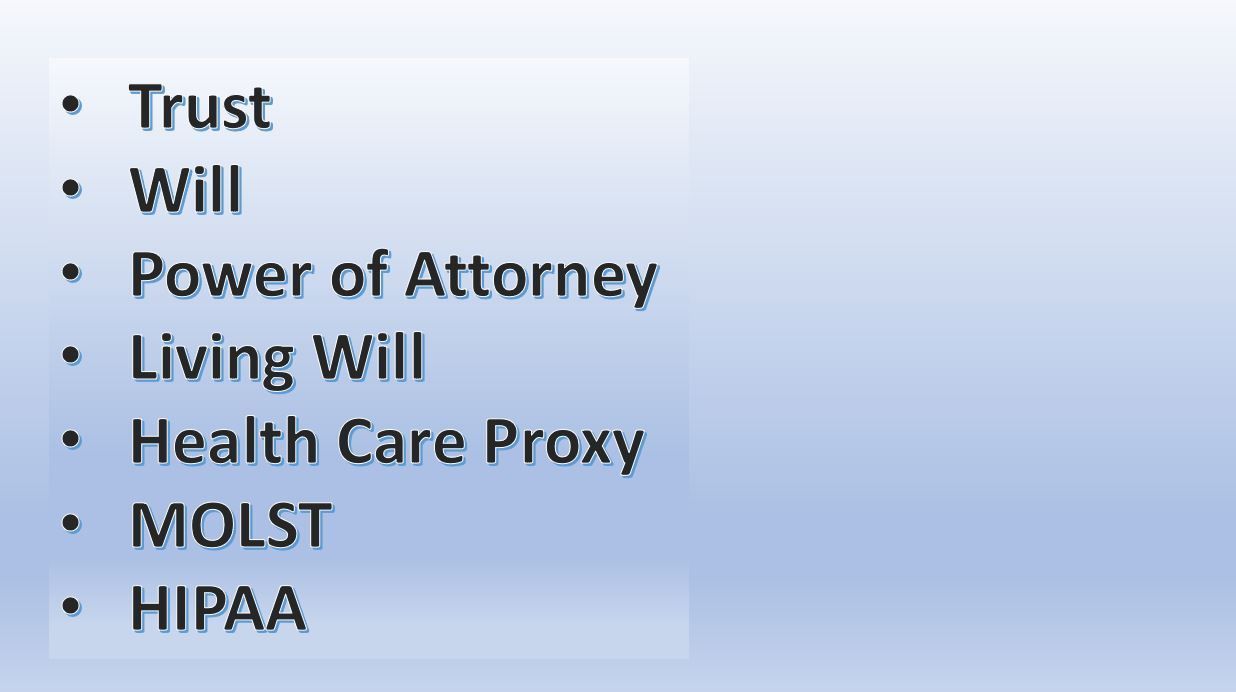

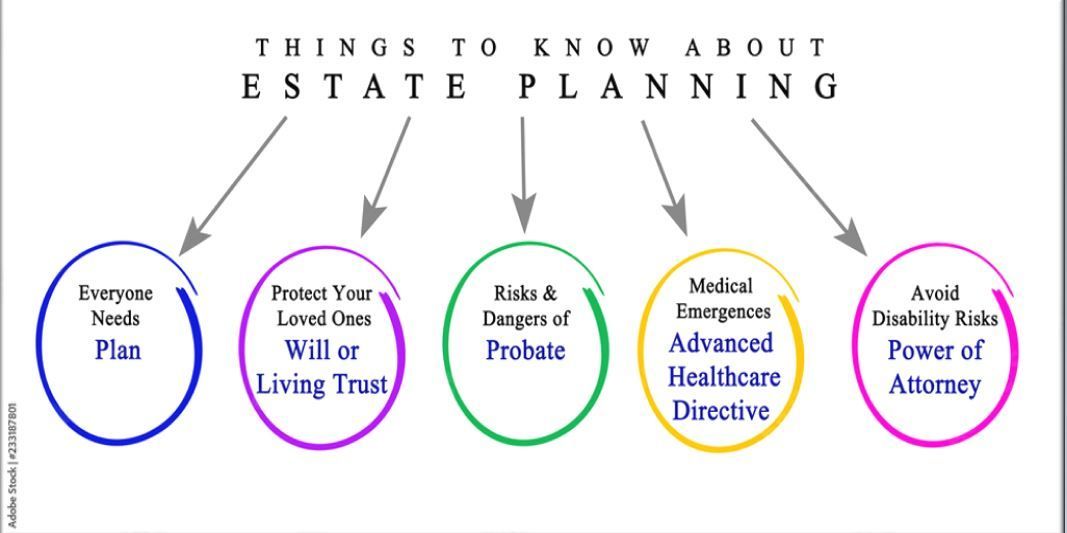

Estate Planning

- Probate

- Wills & Trusts

- Veterans Pension and Eligibility Benefits

- Guardianships (17A (Surrogates Court) and Article 81 (Supreme Court))

Personal Injury

A personal injury occurs whenever you sustain an injury to your body, mind, or emotions. In contrast to property damage, personal injury refers to harm to the person.

Slide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButton

Slide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButtonSlide title

Write your caption hereButton

Serving the following New York Counties:

Bronx, Dutchess, Kings, Nassau, Orange, Putnam, Queens, Rockland, Suffolk, & Westchester.

Including the following cities and towns:

Bedford, Cortlandt, Eastchester, Greenburgh, Harrison, Lewisboro, Mamaroneck, Mount Kisco, Mount Pleasant, Mount Vernon, New Castle, New Rochelle, North Castle, North Salem, Ossining, Peekskill, Pelham, Pound Ridge, Port Chester, Rye, Rye Brook, Scarsdale, White Plains, Yonkers & Yorktown.

BROWSE OUR WEBSITE

HOURS OF OPERATION

- Mon - Fri

- -

- Sat - Sun

- Closed